CAC (Customer Acquisition Cost) refers to the expense you incur in compelling prospects to buy your products. It is a criterion increasingly being used, alongside the development of web organizations together with online marketing efforts that can be followed up. Customarily, in the process of making decisions, an organization needed to carry out shotgun marketing and design techniques to follow up on clients.

In the present, a majority of web organizations can take part in the directly focused marketing to specific groups and follow up on as they transform from prospects to longtime steadfast consumers.

Related: How to Attract the Right Audience to Your Website

The Implication of CAC Metrics

The metric of CAC is imperative to your organization as well as investors. Inward operations together with marketers in your organization are interested in the criterion in order to advance on their investments in promotions. Therefore, if the expenses of acquiring clients are minimized, your organization‘s net revenue improves and as a result reaps tremendous profits.

On the other hand, investors can be in the first steps or potential ones who use it to investigate the versatility of new web-based organizations. They can estimate your organization‘s productivity by taking into account the differences in the amount brought in y clients and the expenses involved the process of obtaining those clients. Investors are interested in your present relations and not in your future guarantees of metric improvements, except if you are in a position to justify them.

Related: Using Video Marketing for Customer Acquisition

CAC Calculation

Essentially, you can determine CAC through the division of the overall cost incurred in drawing in new consumers versus the total number of new clients in a given period. For instance, your organization’s total marketing expenditure was $200 in the year 2018, and you gained 200 new clients still in 2018, then your CAC will be; $200 divided by 200, which is equivalent to $1.

CAC metric still got limitations that you need to keep in mind whenever you are using it. For example, your organization might have marketed its products in a new market segment or invested in the early steps of search engine optimization (SEO), and there is no specific timeframe to expect the outcome. Such a situation is uncommon, but it can pose a challenge in computing the CAC. Therefore, it is advisable to take into account numerous variations to ensure the situation is taken care of.

Related: 11 Tips on How to Make Your Own Sales Video Standout and Close Sales

The Significance of CAC on Every Marketing Avenue

The knowledge of customer acquisition cost on every channel in your marketing process is essential for marketers in your organization. Understanding marketing channels with the minimum CAC is essential because it enables you to determine where twofold down in terms of marketing expenditure. Allocating your budget for marketing on low CAC channels gives you a better opportunity to gain more clients within a low–cost budget.

Determining the cost incurred on every channel can help you use a simplified equation and expect all channels to have “succeeded” in obtaining a similar number of consumers which is an averaging approach.

The arising matter is that it tends to be hard in the determination of each channel’s respective clients.

LTV/CAC Calculation and its Relevance

Estimating the LTV (Life Time Value) of consumers is an additional metric to consider with regards to CAC. LTV refers to the anticipated income one client will create through the span of his relation to your organization.

In computing LTV you will have to consider several variations to come up the required formula;

The Average Value of Purchase: Divide your organization‘s overall income within a specific timeframe by the total purchases within the same timeline which usually is a year.

The Average Frequency of Purchase: Divide the total purchases within the timeframe by the totaling value of special clients who

bought from your organization in the same period.

Consumer Value: Multiply the average value of the purchase by the average frequency of purchase.

Consumer’s Average Lifespan: Average the total value of years a particular consumer maintains his loyalty to your organization.

At that point, determine LTV through the multiplication of consumer value by the consumer’s average lifespan which results to an estimation of the amount of income you can sensibly anticipate that a typical client is bound to create throughout the period he maintains loyalty to your organization.

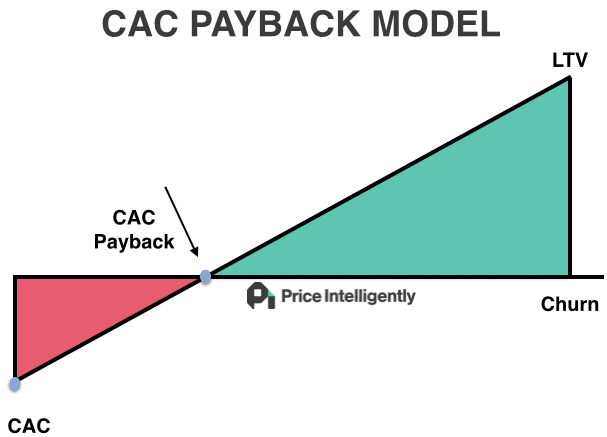

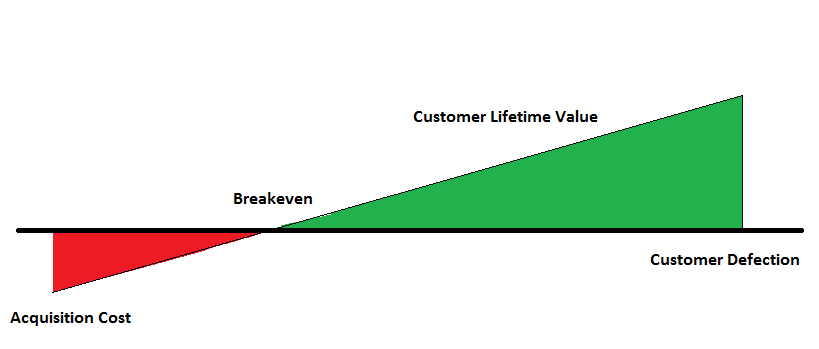

Consequently, the proportion of your organization‘s LTV: CAC is a quick pointer to the consumer’s value in relation to the amount it utilizes in acquiring them. Preferably, it is supposed to last about a year for you to recover the CAC, and the ratio ought to be 3:1; to mean that your consumer’s value is recommended to be 3x the CAC.

Basically, the ratio of LTV to CAC enables you to determine whether the obtained clients are likely to generate more sales than the marketing cost involved in getting them.

Why your Allowable Customer Acquisition Cost is Built Adequately by Life Time Value

Knowledge of the ratio of LTV to CAC enables marketing teams to open up further expenditure plans for their projects. Let’s take, for example; it can enable you to decide if you need to be permitted to invest more in the acquisition of broader consumers who are likely to maintain their loyalty to your organization for a considerable time and generate sufficient revenue within the span.

Allowable CAC refers to the maximum amount allowed to be spent on customer acquisition. It is basically something you can negotiate before with your financing team which is justifiable whenever the desired allowable is high, and your LTV is high as well.

Industries’ CAC

The CAC of each industry varies from the other with regards but not limited to the following factors;

- Consumer’s lifespan

- A cycle of sales’ period

- Frequency in the purchase

- Organization’s maturity

- Value of purchase

Therefore, to place CAC into the setting, the following is a list of the average CAC by industry with regards to different publications;

Travel Industry: $7

Retailing Industry: $10

Consumer Products: $22

Manufacturing Industry: $83

Travel and Transport Industry: $98

Marketing Bureau: $141

Financial Institution: $175

Technology (Equipment): $182

Real Estate Property Industry: $213

Banking and Insurance Industry: $303

Telecommunication Industry: $315

Technology (Programming) Industry: $395

Related: How Can Animated Video Help Your Business?

Different Approaches to Improve CAC

There is a variety of approaches to help you improve your CAC and move towards the 3:1 ratio of LTV and CAC;

Define your target group in the first place to ensure your marketing efforts bear fruits

Being unable to define your target group can make you focus on a more extensive and unspecific group that might not be interested in your products and end incurring fruitless and unnecessary expenses. Therefore, the knowledge of your target group is vital to lower such costs.

Enhance the value of consumers

You need to be able to produce something that pleases your consumers which can be in the form of enhancing extra elements interests them. You can come up with incentives to boost the current products for better placement or additionally implement other strategies to generate revenue from the present consumers.

Focus on improving conversion rates

Ensure the funnel stages are simplified for easy conversion from stage to stage until eventually visitors transform into loyal customers. Customize your website to ensure mobile phone users can fill in forms and shop conveniently, and automate the purchase process that clients can buy any time.

Gain more from social network campaigns

Almost 86% of marketers spend on marketing to gain new consumers which raise the CAC. However, there is no guarantee that through a paid platform, those who come to you will purchase your products. Paying to market your products might not bring out the anticipated outcome unlike posting your content on social networks which tends to go viral and oversee your brand’s global outreach in a few hours.

Improve on engaging visitors

Chances are very low that an individual will discover your site and immediately purchase from you. Your product needs to completely engage prospects for them to convert. If you need to pull in new clients, then establish strong relations. A purchase experience of 70% is dependent on the client’s perspective on he is being handled.

Related: Why Online Video is the Future of Marketing

Improve product quality

Help improve the consumers’ value through the provision of reliable products. Gather clients’ opinions and put the relevant measures in place to respond to their demands and meet their expectations to boost their loyalty.

Improve prospects’ awareness about your products

With respect to the advancement in technological innovations, interested parties can find out about your products by clicking on a button. It’s uncommon for people to buy a product before researching it on the web. Support how your product can solve prospects’ problems by providing educating items on your site hard copies.

Improve your metrics on online conversions

you can set specific objectives on Google optimization and undertake split tests with current checkout frameworks to minimize on bounce rates and enhance your landing page, improve the speed of your website together with other considerations to upgrade the performance of your site.

Introduce referral programs to your consumers

In case you are referred to a prospect by your current client, then if that prospect converts to a consumer, his CAC will be nil. The clients obtained a “freely” guarantee to minimize your CAC gradually.

Join hands

In the present economy globally, organizations never again flourish solely. It is crucial to partner with other marketers to formulate an economic plan of action. You can access new markets by collaborating with a variety of brands not necessarily competitors but brands with similar target groups as yours. That way, you can accomplish much at a low cost.

Let your sales process be efficient and effective

Simplify and fasten your sales process in order to maximize on the purchases you can impact through the span of a year. Apply CRM strategies and make use of prospecting methodologies to interact with quality prospects adequately.

Limit on your marketing expenditure

The acquisition of customers is not really dependent on higher CAC so, you to know how to cut on marketing budgets. Abstain from enrolling extensive marketing personnel to generate higher revenues.

Put into place CRM (Customer Relationship Management)

Almost every effective organization with loyal customers applies a particular type of CRM. You can connect with your consumers regularly via electronic mails, blog posts, customer loyalty frameworks, together with other methods that help maintain the loyalty in your consumers.

Refine your services to clients to boost their loyalty

Individuals tend to keep in mind the intuition they attain in the final stages of purchasing from your product, and furthermore spread it to their loved ones. If the impression was good, then they will spread positive word-of-mouth about your brand, which in the end prompts a minimized marketing which implies a lowered CAC in general.

Conclusion

Acquiring new customers is vital to any organization that needs to improve its income generation gradually. Although the acquisition process comes at a cost (CAC), there are approaches (as stated above) you can implement to counter or lower the cost at a more significant margin and eventually come closer to the ideal ratio of LTV: CAC at of 3:1.

Contact Top Explainers today for more information on how an explainer video can help with customer acquisition.